Industries

Financial Services

Digital disruption in the financial services industry is driving fundamental changes as companies align their service offerings with evolving customer and partner demands. Technology requirements, increased competition, and the need for digitally traceable adherence to regulations and controls means that businesses are re-imagining how they operate.

Challenges facing the Financial Services Sector today

Market disruption

Nimble, highly agile and consumer focused FinTech’s are disrupting the market with niche product lines and lower margins.

Customer Experience

Consumers are demanding, ever faster, better, cheaper omni-channel functionality, with a seamless customer experience. This creates huge challenges for organisations with legacy systems and multiple, unconnected information silos.

Increasing Regulation

Growing regulatory complexity and oversight covering international, national and state based transactions is creating huge financial, process and operational pressures for financial services companies. Today they must respond to regulatory requests for information, analyse the impact of new regulatory policies and implement appropriate risk controls.

Technological Disruption

Rapidly evolving technological capability and process improvements are raising the competitive bar for all financial service organisations. Business leaders must identify cost optimisation opportunities and increase automation while streamlining operational functions and processes for all financial services.

Outcomes delivered by Capsifi

It’s clear that players in the financial services sector must harness all available tools to not only retain market position but also be ready to navigate the disruptions of digitisation, FinTech and increasing competition and regulation.

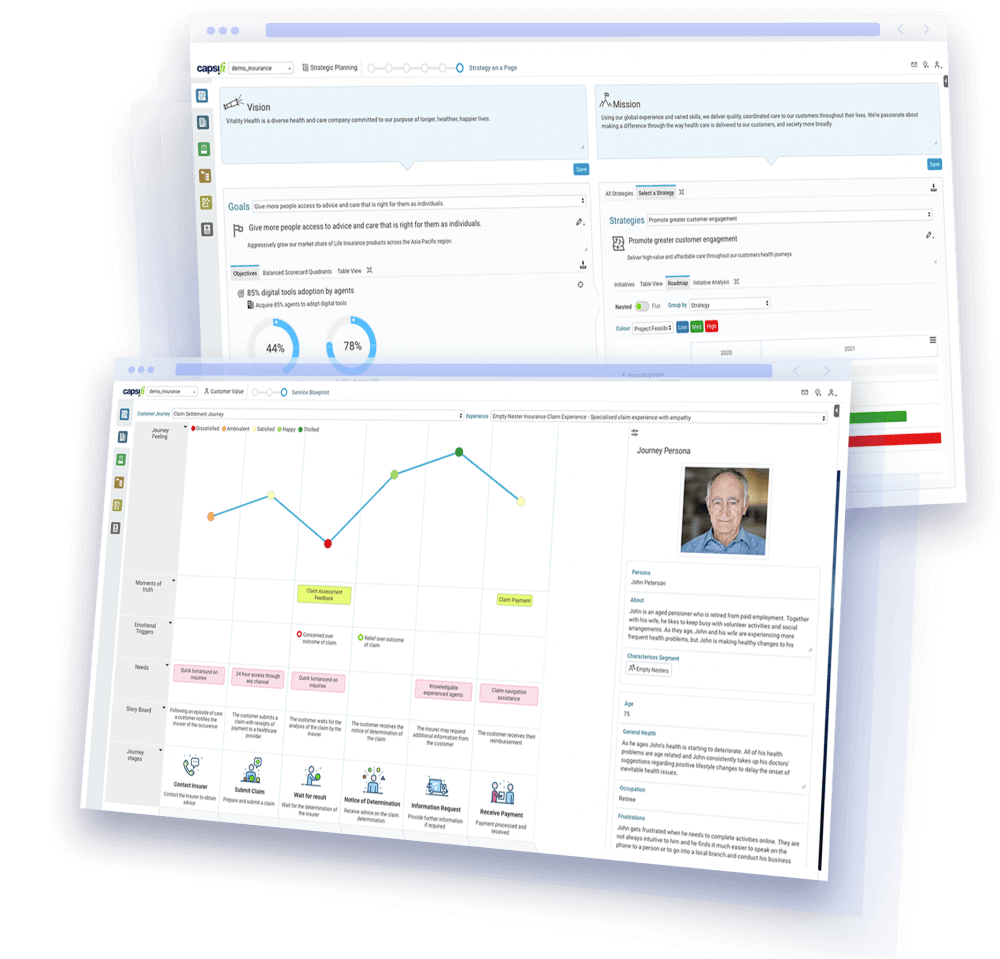

Capsifi’s complete business modelling and architecture platform dynamically consolidates disconnected business knowledge to create a dynamic, interactive view of the organization. This provides financial service organisations with a window into the intricate web of capabilities, processes, and technologies that define the organization, and the ability to tweak the dials of their performance, optimizing every facet of their operation to adapt to changing market dynamics.

Here are some specific outcomes you can expect with Capsifi:

- Fine-tune and refine critical decision-making in real-time

- Develop fully traceable digital operating models

- Enhance rapid response capabilities to changes in strategic priorities due to unforeseen national and global events

- Reduce costs linked to changing regulatory requirements

- Integrate the ‘voice of the customer’ into every aspect of the operating model, including business capabilities, value streams, processes, IT architecture and delivery

- Develop a detailed understanding of the technological and business landscape

Your questions answered

Want to learn more about Capsifi’s impact on financial services organisations? This collection shares some of the most common questions we get from across the globe.

How can Financial Service companies evolve so they’re able to continually set and re-set their strategic priorities?

Managing strategic goals and objectives in an increasingly uncertain and unpredictable environment is a huge challenge. Financial services are having to continually monitor and adapt their strategic direction in response to shifting market needs and regulatory changes. To do this, you need to dynamically align your investment decisions, initiatives and evolving technological implementations.

Capsifi’s complete business modelling and architecture platform helps you achieve this by developing a dynamically linked digital operating model, including strategic objectives, business capability maturity, customer journeys, value streams and initiative roadmaps.

How can Financial Service companies reach a point where they’re continually transforming?

Keeping pace with your competitors and addressing the digital demands of FS customers and partners requires a focus on continuous, systematic transformation. Building your capacity to continually transform, means developing enterprise feedback loops, capturing innovative ideas from front line employees, and having the ability to prioritise against strategic business drivers.

Through its highly evolved Customer Experience and Ideas Management functionality, Capsifi’s Digital Business Platform best helps you build the capacity to transform as well as showing you how to continually adapt your strategic priorities and pivot quickly – realigning your delivery to address customer, partner, and market demands.

How can Financial Services bring the customer into the heart of their operating model?

The relentless pace of technology innovation has shifted the balance of power in customer interactions to the point where digitally enabled customers are now calling the shots. They have access to more responsive, ubiquitous information in evaluating their options than the information processing capabilities of businesses.

To address this issue, financial services need to develop meaningful relationships with their customers and continually access customer experience and needs. Capsifi supports you to develop, reinforce, and adjust product offerings around value propositions targeted specifically at carefully defined customer segments.

You’ll continuously monitor and measure the customer experience across their journeys and their interactions with your business. You’ll have access to an interactive canvas of up-to-the minute customer feedback, dynamically aligned to business levers and all elements of the operating model focused on moving the needle in response to the voice of your customers.

How can financial services reduce the costs associated with managing their governance, risk, and compliance (GRC) landscape?

Regulatory demands on the financial services sector are continually evolving and impacting every aspect of the front, middle and back offices. Companies are having to allocate increasing levels of capital in order to analyse, maintain, and transform their GRC landscapes, and remain compliant. This involves an intricate web of governance processes, risk controls, individual accountabilities, performance metrics and more.

Capsifi helps by digitally mapping, tracing and modelling the intricacies of the GRC landscape. This reduces costs and enables you to respond quickly to regulatory queries, as well as quickly redesigning and transforming GRC requirements in line with new state or federal policies.

Introduce standout capabilities

Capsifi includes all the capabilities needed to drive incredible value across teams, operations and customers.

Pivot quickly

Measure and track progress against your execution of strategic plans, understand where there are challenges and take corrective action fast and early.

Keep resources on track

Identify activities not contributing to clearly defined strategic outcomes and reallocate resources into more appropriate channels.

Blueprint your services

Develop a service blueprint that visually connects the customer experience with your operating model – value streams, business capabilities, process, IT architecture.

Maintain regulatory traceability

Digitally maintain a dynamic and fully traceable catalogue of organizational policies, procedures, regulations and controls.