Industries

Insurance

The insurance industry is facing major challenges as increasingly tech-savvy customers demand lightning-fast, highly personalised transactions, mainly delivered via mobile devices. They want their share of the cost optimisations that technology delivers, with claims processes that are slick, transparent and hassle-free. Insurance companies need the expertise to intimately understand and continually refine the customer experience just to stay relevant and keep pace.

Capsifi Digital Business Platform helps the Insurance Industry deliver highly personalised products to demanding, tech-savvy consumers

Make no mistake, the balance of power in the Insurance Industry is shifting firmly in favour of the end consumer.

Today’s consumers are increasingly digitally savvy. They’re demanding faster transaction times, personalised products and less reliance on intermediaries.

Big data and machine learning (ML) is also playing its part in swinging the needle in favour of personalisation and data analytics. Then there’s the impact of artificial intelligence and automation powering improved claims processes to the mix.

And, of course, this is taking place against a background of FinTech’s driving product innovation and increased mergers and acquisition activity.

Outcomes delivered by Capsifi

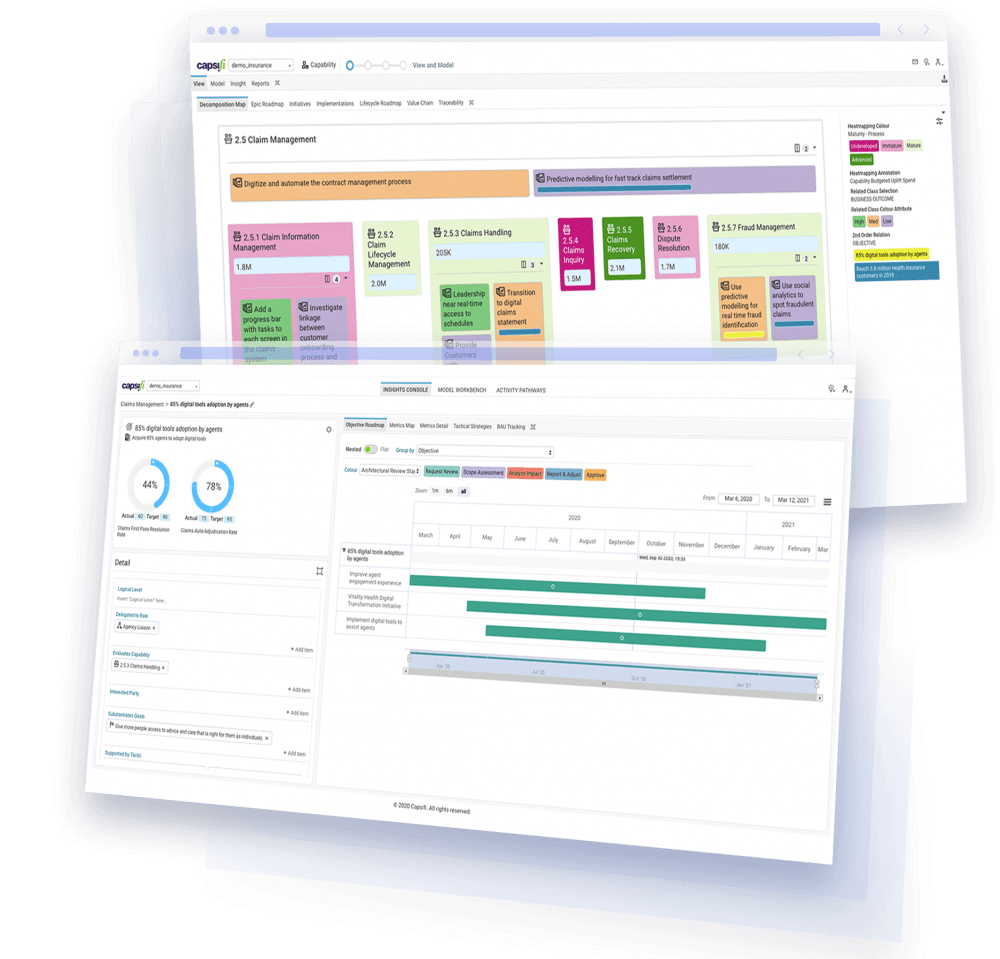

Capsifi’s complete business modelling and architecture platform provides the insurance knowledge management needed to fine-tune and refine critical decision making during real-time workflow.

All while you continually adapt and improve your technology and information management landscapes.

Here are some specific outcomes you can expect with Capsifi:

- Develop fully traceable digital operating models

- Enhance rapid response capabilities to changes in strategic priorities due to unforeseen national and global events

- Reduce costs linked to changing regulatory requirements

- Integrate the ‘voice of the customer’ into every aspect of the operating model, including business capabilities, value streams, processes, IT architecture and delivery

- Develop a detailed understanding of the technological and business landscape

Your questions answered

Want to learn more about Capsifi’s impact on the insurance sector? This collection shares some of the most common questions we get from across the globe.

How can Insurance companies rapidly optimise their Operating Models to achieve continual improvements in performance?

In the insurance sector, even the slightest technological improvement can make a huge difference in claims processing, customer experience and the identification and implementation of cost optimisation opportunities.

Capsifi’s complete business modelling and architecture platform helps your business optimise performance by digitally connecting key elements to drive business as usual (BAU) and transformation initiatives to achieve continual performance improvements.

How can Insurance companies properly harness and manage ideas and suggestions from their front-line employees to continually improve the customer experience?

Claims management teams are a rich source of customer feedback and insight, generating countless ideas for continual improvement.

Most insurance companies don’t have the capability to capture, process and realise these ideas efficiently in order to effectively feed the backlog in line with strategic objectives.

Capsifi’s customer-driven innovation functionality enables the capture of ideas from front line employees, providing the means to systematically manage the prioritisation and development of ideas from concept to use case.

How can Insurance companies achieve continual transformation and performance improvement?

Keeping pace with competitors and addressing the future digital demands of insurance customers requires a focus on continuous, systematic transformation.

Building your capacity to continually transform means developing enterprise feedback loops, capturing innovative ideas from front line employees, and having the ability to prioritise against strategic business drivers.

Capsifi’s solution for insurance companies helps you build the capacity to transform and adapt your strategic priorities and pivot quickly – realigning your delivery to address customer, partner, and market demands.

Introduce standout capabilities

Capsifi includes all the capabilities needed to drive incredible value across teams, operations and customers.

Break down information silos

Identify key issues and areas of improvement across every aspect of your business operation, in an aggregated way that helps look beyond informational silos and at an organization-wide level.

Measure against best practices

Understand where your organisation stands compared to industry best practice and identify where improvements can be made to boost your success.

Achieve buy-in

Get the right executive support and leadership to champion innovation – supported by an understanding of the impact on business performance and the achievement of corporate objectives.

Involve your people

Empower every person in your business to engage in the continual evolution and improvement of the organisation as you create a culture of perpetual improvement.